The first trading session of previous years has always been a whopper for those betting on central planning and capital flows. *In fact, if one adds up the S&P performance on the first trading day of each year going back to 2009 (i.e., 1/2/13: + 2.54%, 1/3/12: + 1.55%, 1/3/11: + 1.13%, 1/4/10: + 1.60%, and 1/2/09: + 3.16%), one gets a whopping 10% return just on that one trading session. *Which is why the fact that futures are glowing read, if only for the moment, may be disturbing for index investors and all those others who put all their faith, not to mention money, in St. Janet. Today's red open is hardly being helped by the 10 Year which continues to drift lower with the yield now at 3.04%, even as the Spanish 10 Year yield just got a 3 handle as well. At this rate the two streams should cross some time in the next two months. Just what a higher yield in the US vs Spain would imply for fair and efficient markets, we leave up to readers to decide.

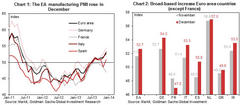

The first trading session of previous years has always been a whopper for those betting on central planning and capital flows. *In fact, if one adds up the S&P performance on the first trading day of each year going back to 2009 (i.e., 1/2/13: + 2.54%, 1/3/12: + 1.55%, 1/3/11: + 1.13%, 1/4/10: + 1.60%, and 1/2/09: + 3.16%), one gets a whopping 10% return just on that one trading session. *Which is why the fact that futures are glowing read, if only for the moment, may be disturbing for index investors and all those others who put all their faith, not to mention money, in St. Janet. Today's red open is hardly being helped by the 10 Year which continues to drift lower with the yield now at 3.04%, even as the Spanish 10 Year yield just got a 3 handle as well. At this rate the two streams should cross some time in the next two months. Just what a higher yield in the US vs Spain would imply for fair and efficient markets, we leave up to readers to decide.In terms of macro events, while China's official and HSBC PMIs as well as that of Australia posted modest disappointing declines, at 52.7, the final Euro area manufacturing PMI for December was unchanged from its flash reading (and the Consensus expectation) and rose by 1.1pt on the month. The German PMI was 0.1pt higher than the flash estimate, while the French PMI was 0.1pt lower than its flash estimate, a 7 month low. Manufacturing expanded on the month in Italy and Spain, and surprised on the upside in both. The trend of disappointing data out of France continues and the recent enactment of the 75% millionaire tax will hardly help. As for the credibility of the peripheral European data, well - check back in a year.

The futures weakness likely has something to do with the EURUSD which has been in freefall all session and has now filled the gap from that ridiculous 200 pip ramp on December 26. Keep an eye on the pair as more turn bearish on the Euro to start the year.

*A quick recap of global markets on the first trading day of 2014:*

European shares fall with the basic resources and utilities sectors underperforming and media, travel & leisure outperforming. The Spanish and French markets are the worst-performing larger bourses, the Dutch the best. The euro is weaker against the dollar. Portuguese 10yr bond yields fall; Spanish yields decline. Commodities little changed, with silver outperforming. U.S. jobless claims, ISM manufacturing, construction spending data released later.

· S&P 500 futures down 0.2% to 1836.8

· Stoxx 600 down 0.4% to 327

· US 10Yr yield down 1bps to 3.02%

· German 10Yr yield up 3bps to 1.96%

· MSCI Asia Pacific down 0.6% to 140.5

· Gold spot up 1.5% to $1219.5/oz

*EUROPE*

· 3 out of 19 Stoxx 600 sectors rise; media, travel & leisure outperform, basic resources, utilities underperform

· 32.2% of Stoxx 600 members gain, 65.2% decline

· Euro-zone Dec. manufacturing PMI 52.7 inline with est.

· Top Stoxx 600 gainers: Fiat SpA +12.4%, Hikma Pharmaceuticals PLC +5.4%, Telecity Group PLC +4.8%, Metso OYJ +4.6%, Pandora A/S +4.4%, Exor SpA +4%, Vestas Wind Systems A/S +3.9%, International Personal Finance +3.5%, Hellenic Telecommunications Or +3.3%, Banco Comercial Portugues SA +3.2%

· Top Stoxx 600 decliners: Ophir Energy PLC -6.1%, Bankia SA -5.6%, TGS Nopec Geophysical Co ASA -5.2%, Banco de Sabadell SA -3.4%, K+S AG -3.3%, Aberdeen Asset Management PLC -3.3%, CGG SA -3%, Aker Solutions ASA -3%, Aurubis AG -2.8%

*ASIA*

· Asian stocks fall with the Kospi underperforming.

· MSCI Asia Pacific down 0.6% to 140.5

· Nikkei 225 closed, Hang Seng up 0.1%, Kospi down 2.2%, Shanghai Composite down 0.3%, ASX up 0.3%, Sensex down 1.2%

· 0 out of 10 sectors rise with utilities, industrials outperforming and energy, tech underperforming

· Gainers: China International Marine Con +12.7%, China Everbright International +9.8%, Newcrest Mining Ltd +8.3%, AAC Technologies Holdings Inc +7.7%, Chicony Electronics Co Ltd +6%, Epistar Corp +5.7%, Kalbe Farma Tbk PT +5.6%, Sino Biopharmaceutical Ltd +5.5%, Sihuan Pharmaceutical Holdings +5.2%

· Decliners: True Corp PCL -9.3%, BEC World PCL -8.9%, Home Product Center PCL -8.6%, Central Pattana PCL -8.5%, Siam Commercial Bank PCL/The -8.4%, Minor International PCL -8.2%, Airports of Thailand PCL -7.6%, Glow Energy PCL -7.4%, Banpu PCL -7.4%, Hyundai Wia Corp -7.4%

*Overnight bulletin summary from Bloomberg and RanSquawk*

· Despite opening in positive territory after a record close on Wall Street, European indices have since pared the gains in what has been a relatively light session.

· FX markets continue to trade with relatively thin volumes following the New Year period. With USD benefiting from market talk of hedge fund names buying in USD/CHF.

· Going forward, market participants will get to digest the release of the weekly jobs report, ISM Manufacturing report for the month of December and also refunding announcement by the US Treasury.

· 10Y yields begin 2014 above 3.00%, ~120bps over levels seen at start of 2013; Treasuries delivered a total return of -3.35% last year, according to BofAML indexes, first annual loss since 2009, as Fed tapers bond buys.

· U.S. investment-grade corporates lost 1.45% last year while high yield bonds returned 7.4%, also according to BofAML indexes; the S&P 500 rallied 30%, its biggest yearly advance in 16 years

· A gauge of U.K. manufacturing fell to 57.3 in Dec. from a revised 58.1 while a separate report showed manufacturing in China weakened last month

· China’s yuan touched a 20-yr high as PBOC Deputy Governor Yi Gang yesterday said the nation will expand the opening up of the foreign-exchange market and increase the number of participants

· Japan’s population declined by the most on record in 2013, highlighting the demographic challenges faced by Abe in his campaign to revive the world’s third-biggest economy

· Italy 10Y yields fell to the lowest level since May after an industry report showed the nation’s factory output expanded at the fastest pace since April 2011

· The Northeast is bracing for a winter storm that is forecast to dump more than a foot of snow across parts of the region, threatening road closures after causing hundreds of flights to be canceled

· Part of Obamacare is on hold in a Colorado case until at least tomorrow, as the U.S. Supreme Court considers contentions from religious groups that say they don’t want to facilitate coverage for contraception

· Sovereign yields mostly higher; EU peripheral spreads tighten as Italy, Spain, Ireland and Portugal bonds rally. Nikkei closed for holiday; Japan reopens Jan. 6. Shanghai -0.3%. European stocks and U.S. equity-index futures decline. WTI crude little changed, copper and gold gain

*Market Re-Cap from RanSquawk*

Stocks in Europe have failed to maintain early gains and gradually moved into negative territory in what has been a liquidity-thinned trading session. Nevertheless, Italian based FTSE-MIB outperformed since the open and remained in the green, where Fiat shares traded up over 14% following pre-market reports that the company has reached a deal to buy the remaining 41.5% of Chrysler shares for USD 3.65bln. The move lower was in part driven by touted profit taking related flow, as well as somewhat cautious sentiment which was observed overnight in Asia following the release of less than inspiring data from China. Of note, Korea's benchmark stock index suffered its biggest loss since mid-2012, with automakers under selling pressure after Hyundai Motor and Kia Motors said they are bracing for their weakest sales growth in more than a decade this year.

There was little in terms of fresh central bank rhetoric this morning, but ECB's Weidmann said that policy makers should charge more interest if they decide to offer additional long term loans to prevent carry trades.

*Asian Headlines*

Chinese HSBC Manufacturing PMI (Dec) M/M 50.5 vs. Exp. 50.5 (Prev. 50.8)

Chinese Manufacturing PMI (Dec) 51.0 vs. Exp. 51.2 (Prev. 51.4)

A Chinese state economist has said that 2014 GDP may grow 7.5%, according to Sec. News.

*EU & UK Headlines*

Euro-Zone PMI Manufacturing (Dec F) M/M 52.7 vs Exp. 52.7 (Prev. 52.7)

German PMI Manufacturing (Dec F) M/M 54.3 vs Exp. 54.2 (Prev. 54.2)

French PMI Manufacturing (Dec F) M/M 47.0 vs Exp. 47.1 (Prev. 47.1) - 7 month low

Italian PMI Manufacturing (Dec) M/M 53.3 vs Exp. 51.8 (Prev. 51.4) - Highest since April 2011

Spanish PMI Manufacturing (Dec) M/M 50.8 vs Exp. 49.8 (Prev. 48.6)

UK PMI Manufacturing (Dec) M/M 57.3 vs Exp. 58.0 (Prev. 58.4, Rev. 58.1)

ECB's Weidmann says policy makers should charge more interest if they decide to offer additional long term loans to prevent carry trades.

The Italian 10y yield has dropped below 4% for the first time since May 23 supported by domestic buying and the earlier PMI Manufacturing release which came in at 53.3 vs Exp. 51.8, which is the highest reading since April 2011.

According to an FT survey, Britain's economic recovery is expected to strengthen in 2014 as the world's sixth-largest economy shrugs off fears for the sustainability of the upswing.

*Equities*

Despite opening in positive territory after a record close on Wall Street, European indices have since pared the gains in what has been a relatively light session. The notable outperformer has been the FTSE MIB, which has been lead higher by Fiat after reports that the Co. are to buy the remaining 41.5% of Chrysler shares for USD 3.65bln. Elsewhere, RWE shares did put some downward pressure on the Utilities sector after it was reported that the Co. are to seek option to boost capital by 10% at the next annual shareholder meeting. Furthermore, it is worth noting that retail related stocks likely to come under a greater scrutiny this morning and over the coming weeks as market participants review holiday trading performance.

*FX*

FX markets continue to trade with relatively thin volumes following the New Year period. With USD benefiting from market talk of hedge fund names buying in USD/CHF which has seen some upside for the pair and EUR/CHF. Elsewhere, markets have been largely unreactive to this mornings mixed Manufacturing PMIs from the Eurozone. Furthermore, NZD/USD has recently broken below the 200 DMA following this recent resurgence in the greenback.

*Commodities*

India 2014 gold imports seen at 350 tonnes to 400 tonnes on curbs.

Iraq exported an average of 2.341mln bpd in December, down from 2.381mln bpd in November, according to an oil ministry spokesman.

Libya oil minister official says Libya oil fields combined capacity is about 280kbpd.

Bernstein lowered their 2014 Brent and WTI crude forecasts by USD 1 to USD 110 and USD 101 respectively and say that global oil demand will rise to 1.3mln bpd in 2014 on global economic growth.

Iran and six world powers have proposed Jan. 20 as the date to implement the Geneva deal, according to PressTV, citing the head of Iran's expert-level nuclear negotiation team.

China's ambassador to London has launched a strong criticism of the Japanese PM Abe, accusing him of deliberately raising tensions in Asia and putting the world on a 'perilous path.' Reported by Zero Hedge 2 days ago.