This week, markets are likely to focus on US ISM Nonmanufacturing, services and composite PMIs in the Euro area (expect increases), ECB’s Monetary Policy Decision (expect no change in policy until further ahead), and Congressional testimony by Fed’s Yellen.

This week, markets are likely to focus on US ISM Nonmanufacturing, services and composite PMIs in the Euro area (expect increases), ECB’s Monetary Policy Decision (expect no change in policy until further ahead), and Congressional testimony by Fed’s Yellen.In DMs, the highlights for the week include [on Monday] US ISM Nonmanufacturing (expect an increase to 54.5 vs. consensus 54.0); [on Tuesday] US Trade Balance (expect a slight decline in the deficit), Euro area’s final composite PMI (expect 54) and an average rise in services PMIs in Italy and Spain (of around 1.8pt), Australia Monetary Policy Decision (expect rates on hold, but possibly also shift to more benign view on inflation and less comfort on elevated AUD), and UK Composite PMI (strong at 57.5); [on Wednesday] US Nonfarm productivity (expect a decline) and Fed’s Yellen testimony in Congress, in addition to France IP and Germany factory orders (expect positive growth); [on Thursday] Monetary Policy Decisions at ECB (expect no change in policy; looking further ahead, there is a 40% probability of a cut in policy rates and/or liquidity measures in the coming months), BoE and Norges Bank (expect no change in policy either); [on Friday] US wholesale trade, Italy IP, Japan leading index and South Korea Monetary Policy Decision (expect rates on hold, possibly with a softer tone).

In EMs, attention will focus on Chinese data (expect improvements in trade and a fall in inflation), Monetary Policy Decisions in Czech Republic, Indonesia, Malaysia, Peru, Philippines, Poland and Romania (all mostly on hold, with nuances), in addition to various PMI and inflation prints. Among other releases, markets will likely focus [on Monday] PMIs in China (HSBC/Markit), Russia, and South Africa; [on Tuesday] Romania Monetary Policy Decision (rates on hold but likely with an ease of minimum RRRs on RON- and FX-denominated liabilities) and Mexico consumer confidence; [on Wednesday] Monetary Policy Decisions in Poland (rates on hold and possibility of small dovish shift in tone) and Czech Republic (rates on hold but possibly also an indication that the FX peg may remain in place for longer); [on Thursday] Monetary Policy Decisions in Peru (rates on hold and reiteration of neutral bias) and Philippines (rates on hold but a hike in RRR); [on Friday] CPI inflation in China (expect 2.0% yoy, likely reflecting weak demand growth and low fresh food prices) and Brazil (expect an increase to 6.4% yoy).

*There are no pre-announced events to anchor market attention around the situation in Ukraine next week, but headlines are likely to reflect continued tensions; a few speeches by policy makers and the OECD's economic outlook are also important to follow*. Next week there are no specific dates that could potentially anchor market’s attention around the conflict. But US President Obama and German Chancellor Merkel referred to May 25---the date of the elections in Ukraine---as the next potential trigger of a broader set of sanctions against Russia. Next week will also see a few speeches by policy makers, including ECB’s Draghi and Mersch; Fed’s Yellen, Bullard, Evans, Plosser, Stein and Tarullo. On Tuesday, the OECD publishes its Global Economic Outlook, including revised projections. Their current GDP growth forecast for member countries stands at 2.3%.

*Monday, May 5*

· Events: Speech by ECB’s Mersch; Meeting of Euro area Finance Ministers.

· United States | ISM Non-Manf. Composite (Apr): Consensus 54.0, previous 53.1

· Sweden | Industrial Production MoM (Mar): Consensus 0.50% (1.50% yoy), previous 2.20% (1.70% yoy)

· Australia | Building Approvals MoM (Mar) : Consensus 1.50%, previous -5.00%

· China | HSBC/Markit Manufacturing PMI (Apr): Consensus 48.4, previous 48.3

· Russia | HSBC Russia Manufacturing PMI (Apr): Consensus 48.0, previous 48.3

· Turkey | CPI YoY (Apr): GS 8.90%, consensus 8.83%, previous 8.39%

· South Africa | Kagiso Manufacturing PMI (Apr): Consensus 50.2, previous 50.3

· Chile | Economic Activity YoY (Mar): Consensus 2.90%, previous 2.90%

· Colombia | CPI YoY (Apr): Consensus 2.60%, previous 2.51%

· Also interesting: [DM] US Services PMI; Euro area PPI; Australia Retail Trade, Building Approvals, and Unemployment; Singapore PMI. [EM] Trade Balance in Hungary and Nigeria; South Africa Unemployment; Romania Retail Sales.

*Tuesday, May 6*

· Events: Speech by Fed’s Stein; OECD publishes Global Economic Outlook.

· United States | Trade Balance (Mar): Consensus -$40.2B, previous -$42.3B

· Euro area | Markit Euro area Composite PMI (Apr F): Consensus 54, previous 54

· Euro area | Markit Euro area Services PMI (Apr F): Consensus 53.1, previous 53.1

· Italy | Markit/ADACI Italy Services PMI (Apr): Consensus 50.5, previous 49.5

· Spain | Markit Spain Composite PMI (Apr): Previous 54.2

· Australia | Monetary Policy Decision: Rates are expected to remain on hold at 2.50%, same as previous

· Australia | Trade Balance (Mar): Consensus 1000M, previous 1200M

· Mexico | Consumer Confidence Index (Apr): Consensus 90, previous 88.8

· Philippines | CPI YoY (Apr): Consensus 4.10%, previous 3.90%

· Also interesting: [DM] Composite and Services PMI final April readings for France, Germany and Japan; Italy, Spain and Sweden Services PMI; Euro area Retail Sales; Unemployment in Norway and Spain; UK Services PMI; BoJ Monetary Policy Decision Minutes; Canada Int’l Merchandise Trade. [EM] Composite and Services PMI in Brazil and India; Czech Republic Trade Balance; Hungary Retail Sales; Chile Monetary Policy Decision Minutes; Brazil PPI; CPI in Ukraine and Taiwan.

*Wednesday, May 7*

· Events: Fed’s Yellen testifies to Joint Economic Committee; Speeches by EU’s Barroso, Italy’s Renzi.

· United States | Nonfarm Productivity (1Q P): Consensus -0.80%, previous 1.80%

· United States | Unit Labor Costs (1Q P): Consensus 2.40%, previous -0.10%

· France | Industrial Production MoM (Mar): Consensus 0.30% (0.50% yoy), previous 0.10% (-0.80% yoy)

· Germany | Factory Orders MoM (Mar): Consensus 0.30% (4.30% yoy), previous 0.60% (6.10% yoy)

· New Zealand | Wage Inflation QoQ (1Q): Consensus 0.5%, previous 0.6%

· Poland | Monetary Policy Decision: Rates are expected to remain on hold (at 2.50%, same as previous). A benign inflation outlook, the possibility of more easing in the Euro area, and a progressing recovery affected by lower exports to Russia and Ukraine, appear to have led a number of committee members to indicate a preference for a longer on-hold period. However, the committee remains cautious overall, and sees risk from expected increases in US rates.

· Czech Republic | Monetary Policy Decision: Rates are expected to remain on hold at 0.05%, same as previous

· Czech Republic | Industrial Output YoY (Mar): Consensus 8.00%, previous 6.70%

· Brazil | Industrial Production YoY (Mar): GS -3.00%, consensus -2.60%, previous 5.00%

· Also interesting: [DM] US Consumer Credit; France Trade Balance; Switzerland FX reserves and Unemployment; Canada Building Permits; Australia Retail Sales. [EM] Czech Republic Retail Sales; Trade Balance in Chile, Malaysia, and Taiwan; Hong Kong PMI; Russia Services and Composite PMI; Mexico Leading Indicators and Vehicle Production; Thailand Consumer Confidence.

*Thursday, May8*

· Events: ECB’s Draghi holds press conference after Monetary Policy Decision; Speeches by Fed’s Evans, Bullard, Plosser and Tarullo, in addition to SNB’s Danthine; Germany’s Merkel and Schaeuble attend Europe Conference.

· Euro area | Monetary Policy Decision: Consensus expectes rates on hold at 0.25%. Looking further ahead, the ECB is expected to reinforce its current policy stance should financial conditions tighten undesirably. Judging from its latest statements, the hurdle for further action is low and, on this basis, there is a 40% probability of a cut in policy rates and/or liquidity measures in the coming months.

· United Kingdom | Monetary Policy Decision: Rates are expected to remain on hold at 0.50%, same as previous; asset purchases at £375BG, same as previous.

· Norway | Monetary Policy Decision: Rates expected on hold at 1.5%, same as previous

· Germany | Industrial Production SA MoM (Mar): Consensus 0.20%, previous 0.40%

· Spain | Industrial Output NSA YoY (Mar): Consensus 2.00%, previous 3.10%

· Switzerland | CPI MoM (Apr): Consensus 0.10% (0.10% yoy), previous 0.40% (0.00% yoy)

· Norway | Manufacturing Production MoM (Mar): Previous 0.20%

· Hungary | Industrial Production WDA YoY (Mar P): Previous 8.10%

· Turkey | Industrial Production MoM (Mar): Consensus -0.50% (3.70% yoy), previous -0.10% (previous 4.90%)

South Africa | Manufacturing Prod SA MoM (Mar): Previous -1.90% (1.40% yoy)

· Mexico | CPI MoM (Apr): Vonsensus -0.11% (3.58% yoy), previous 0.27% (3.76% yoy)

· Chile | CPI MoM (Apr): Consensus 0.20% (3.90% yoy), previous 0.80% (3.50% yoy)

· Also interesting: [DM] UK RICS Housing Market Survey; Canada Housing Starts and New Housing Price Index; Unemployment in Australia and New Zealand; New Zealand QV House Prices. [EM] Romania Wage Statistics; Hungary Trade Balance.

*Friday, May 9*

· Events: Speeches by Fed’s Kocherlakota, ECB's Costa and RBA’s Dabelle.

· United States | Wholesale Trade Sales MoM (Mar): Consensus 1.20%, previous 0.70%

· Italy | Industrial Production MoM (Mar): Consensus 0.30%, previous -0.50%

· Norway | CPI MoM (Apr): Consensus 0.40% (1.80% yoy), previous 0.20% (2.00% yoy)

· United Kingdom | Industrial Production MoM (Mar): Consensus -0.20%, previous 0.90%

· Japan | Leading Index CI (Mar P): Consensus 106.7, previous 108.9

· South Korea | Monetary Policy Decision: Rates expected to remain on hold (at 2.50%, same as consensus and previous 2.50%). The tone could soften somewhat given apparent weakness in private sector activity following the recent ferry sinking tragedy.

· China | CPI YoY (Apr): consensus 2.10%, previous 2.40%

· Brazil | CPI IPCA (Apr): consensus 0.79% (6.41% yoy), previous 0.92% (6.15% yoy)

· Mexico | Gross Fixed Investment (Feb): consensus -1.20%, previous -2.40%

· Argentina | GDP YoY (4Q): Consensus 2.70%, previous 5.50%

· Also interesting: [DM] US Wholesale Inventories; Trade Balance in Germany and Denmark; France Budget Balance; UK Trade Balance; Unemployment in Canada and Sweden. [EM] China PPI; Colombia Monetary Policy Decision Minutes; Philippines Exports; Peru Trade Balance

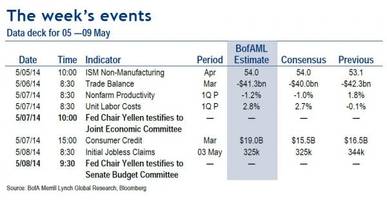

And all of the above in simplified chart format:

Source: Goldman, BofA Reported by Zero Hedge 2 hours ago.