Ahead of this Thursday's ECB meeting, speculation is rife about what Mario Draghi will announce, and as the following Nomura chart highlights most pundits are convinced that the most likely announcement is a cut in the refi and deposit rate with a probability of around 90%, an LTRO in distant third at 34%, and a full blown QE dead last with 10%.

Ahead of this Thursday's ECB meeting, speculation is rife about what Mario Draghi will announce, and as the following Nomura chart highlights most pundits are convinced that the most likely announcement is a cut in the refi and deposit rate with a probability of around 90%, an LTRO in distant third at 34%, and a full blown QE dead last with 10%.However, as SocGen predicts, which is rather aggressive in its assumptions expecting a negative deposit rate of -0.1%, a targeted LTRO to "boost lending to the private sector", and a "signal" of €300 billion in asset purchases, the bulk of this new-found liquidity will almost exclusively go to boost capital markets, and the wealth effect. As for the broader economy? "*We do not expect the 5 June measures to deliver a significant impulse to the real economy*. Should euro area policy makers step back further from austerity, this would lift the economy in the short-term. Ultimately, however, the euro area needs deep structural reform. For all the energetic talk and many promises, actual progress on this front remains all too slow."

Which, as is all too clear by now, is precisely what QE does: it stimulates risk assets, and does little if anything to promote actual economic growth: for that Keynesian doctrine demands a surge in loan and credit-money creation, something Europe, with its -2.0% annual contraction in lending to the private sector, will hardly experience.

More observations from SocGen on what Draghi may announce this week:

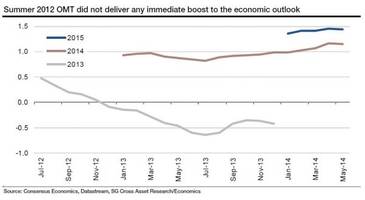

With just four days left to the 5 June ECB meeting, the excitement is palpable. When President Draghi announced the OMT back in the summer of 2012, the impact on financial markets was spectacular; spreads narrowed, equities rallied and the euro appreciated. Consensus growth estimates, however, tracked lower (!) as the forecast for 2013 dropped from 0.5% to -0.4%. Granted, the ECB must be given some credit for the 1.2% growth now forecast for 2014. Notably, in easing market pressure on governments, fiscal drift also provided part of the answer. Recovery in key export markets was an additional boon.

Should the ECB deliver a truckload of liquidity on 5 June, we have no doubt that financial markets will rally. Short of announcing monetary financing of fiscal stimulus, which is forbidden by the Treaty, *we believe that the impact on the real economy is likely to be very modest*. As Italy prepares to take over the European Presidency, the hope is that Prime Minister Renzi will be able to drive a new European agenda delivering growth and jobs. Our concern remains that this will prove all too slow to give the medium-term growth outlook, of around 1.5%, the boost it really needs.

*5 June shopping list: Negative deposit rate, targeted LTRO, ....*

With numerous possibilities on the table, most forecasts for the ECB resemble a shopping list, with lots of items but not all equally important. Our ECB preview offers all the details, but of the major items we expect (1) a negative deposit rate (-0.1%), (2) a targeted LTRO to boost lending to the private sector, and (3) a signal of asset purchases – we look for €300bn of purchases in 2H14, split between €100bn of ABS and €200bn of European issues (EFSF/ESM, EIB, etc.) and liquid, high-grade privates assets.

In this first round, we do not expect to see large scale sovereign asset purchases. To trigger large-scale sovereign asset purchases, we believe a more significant deterioration of the outlook is required. Even then, we remain concerned that the ECB would not be able to make such purchases on a pari-passu basis.

Easier monetary policy conditions will feed through to the real economy through the following main channels:

· *A weaker euro will deliver higher import prices ... and may be slow to impact exports*: as we discussed on these pages a few weeks ago, the lesson from both the recent experiences of the BoE and BoJ is that a weaker currency may not do much to boost exports in the short-term, but will erode household purchasing power via higher import prices. Rules of thumb suggest that a permanent 10% depreciation of the trade weighted euro would boost GDP by around 0.7% in the first year after the shock. Our concern is that this elasticity may at present be lower for two main reasons. First, a significantly weaker euro could come with a new widening of peripheral spreads. Second, slowing demand in emerging economies, and China in particular, is unlikely to be offset by any price effect.

· *A negative deposit rate comes with a cost: the main motivation for a negative deposit rate is to weaken the currency*. To our minds, this has already been factored in by markets and we think it unlikely that this measure will deliver much further euro depreciation. The experience from Denmark, however, illustrated that negative deposit rates also carry a cost.

· *Portfolio reallocation effects may even boost the euro ... but wealth effects are slow to trickle down*: should markets deliver a thumbs-up to the ECB on 5 June, then flows in the hunt for yield could deliver a very significant boost to euro area assets ... and may even lift the euro! Stronger asset prices are welcome, but experience shows that such effects are again slow to trickle down to the real economy, unless the boost is to real estate prices.

· *Credit conditions are already favourable in the core - easing financial fragmentation would be helpful: *the hope is that a targeted LTRO program would trigger a wave of SME lending, resulting in job creation across the euro area. It is worth recalling that in the core, SME lending conditions are already quite favourable. In the periphery, red tape and bureaucracy, already high debt levels and a lack of domestic demand are other factors holding back SMEs. Easing financial conditions for SMEs in the periphery is helpful, deep rooted structural reform would be even better.

*In sum, we do not expect the 5 June measures to deliver a significant impulse to the real economy. *Should euro area policy makers step back further from austerity, this would lift the economy in the short-term. Ultimately, however, the euro area needs deep structural reform. For all the energetic talk and many promises, actual progress on this front remains all too slow.

Also considering that once again just Draghi's jawboning has managed to push the EURUSD lower by a massive 400 pips in the past month, from 1.40 to 1.36, the central banker may opt to do nothing at all, as the core target of ECB intervention, a weaker currency, has already been achieved. It is unclear if the former Goldmanite would risk this: after all as Deutsche Bank said, zero action by the ECB this week would destroy what credibility it may have left.

Which means that once again, well over 5 years into this "recovery", the one segment of the population to benefit from whatever the ECB will unveil will be those very rich few who will immediately benefit from the surge in risk assets. As for everyone else, keep up the hope.

The only remaining question is how much of the ECB intervention has already been priced into risk assets. Considering the relentelss surge in both global stocks *and *bonds, one would be tempted to say that this is shaping up to be more of a "sell the news" type of event... Reported by Zero Hedge 2 hours ago.