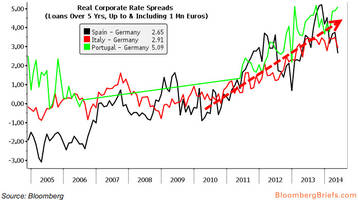

With peripheral European sovereign bond yields at or near record lows, no matter how much GDP gets downgraded (Italy), banking system collapses (Portugal), or loan losses surge (Spain); things must be great for borrowers, right? Wrong! And this is exactly what keeps Mario Draghi up at night... In fact, as the following dismal reality chart shows, *real corporate lending spreads are at record highs...* crushing the credit-created-growth dream of a European Renaissance.

With peripheral European sovereign bond yields at or near record lows, no matter how much GDP gets downgraded (Italy), banking system collapses (Portugal), or loan losses surge (Spain); things must be great for borrowers, right? Wrong! And this is exactly what keeps Mario Draghi up at night... In fact, as the following dismal reality chart shows, *real corporate lending spreads are at record highs...* crushing the credit-created-growth dream of a European Renaissance.As Bloomberg Briefs' David Powell notes,

*One of the euro area’s greatest monetary problems is the large divergence in real corporate borrowing rates.* For example, the spread between the real corporate borrowing rates in Portugal and Germany for loans over five years up to and including 1 million euros stood at 5.09 percentage points in May. The spreads versus Germany are 2.91 percentage points for Italy and 2.65 percentage points for Spain.

Those spreads rise using the latest inflation figures, which are for June. They measure 5.39 percentage points for Portugal, 3.51 percentage points for Italy and 3.25 percentage points for Spain. The spreads on loans of that category are among the highest. That may be because they are mostly provided to small and medium-sized corporations.

* * *

The bottom line is for these to improve, Draghi (or the ECB and thus the German taxpayers) will need to subsidize lending to SMEs in the periphery by a massive amount... the problem being, no one knows if there is even demand for this debt as the region deleverages in its balance sheet recession. Reported by Zero Hedge 30 minutes ago.