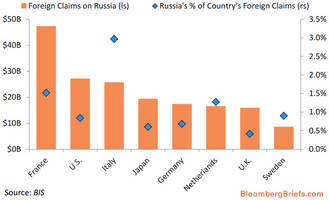

*US and European financials faded notably after Europe and then US unveiled new sanctions against Russia today*. Most notably, the decision to sanction Russia's largest banks (and ban trading and capital markets access) has ramifications for the global financial system's stability given the increasingly inter-connected nature of the world. For that reason, we thought Bloomberg Briefs' chart of the *most exposed banking systems by nation to any systemic issues in Russia* would be useful.

*US and European financials faded notably after Europe and then US unveiled new sanctions against Russia today*. Most notably, the decision to sanction Russia's largest banks (and ban trading and capital markets access) has ramifications for the global financial system's stability given the increasingly inter-connected nature of the world. For that reason, we thought Bloomberg Briefs' chart of the *most exposed banking systems by nation to any systemic issues in Russia* would be useful.As Maxime Sbaihi reports,

About *74 percent of foreign banks’ claims on Russia originated from Europe in the first quarter*, according to the Bank for International Settlements.

French banks had the most claims ($47 billion), followed by the *U.S. ($27 billion)* and Italy ($26 billion).

*Italian banks appeared to be the most exposed in the percentage of the country’s total foreign claims*, of those reporting data.

Source: Bloomberg Briefs

* * *

With Europe set to wake up to Portugal banking system imploding after BES headlines late today, we are sure Italy's and France's banks can handle the additional risk-off... Reported by Zero Hedge 7 hours ago.