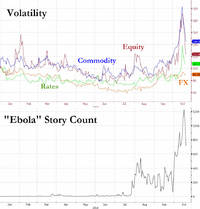

And just like that, the Ebola panic is back front and center, because after one week of the west African pandemic gradually disappearing from front page coverage and dropping out of sight and out of mind, suddenly Ebola has struck at global ground zero. While the consequences are unpredictable at this point, and a "follow through" infection will only set the fear level back to orange, we applaud whichever central bank has been buying futures (and the USDJPY) because they clearly are betting that despite the first ever case of Ebola in New York, that this will not result in a surge in Ebola scare stories, which as we showed a few days ago, may well have been the primary catalyst for the market freakout in the past month.

And just like that, the Ebola panic is back front and center, because after one week of the west African pandemic gradually disappearing from front page coverage and dropping out of sight and out of mind, suddenly Ebola has struck at global ground zero. While the consequences are unpredictable at this point, and a "follow through" infection will only set the fear level back to orange, we applaud whichever central bank has been buying futures (and the USDJPY) because they clearly are betting that despite the first ever case of Ebola in New York, that this will not result in a surge in Ebola scare stories, which as we showed a few days ago, may well have been the primary catalyst for the market freakout in the past month.For those who missed events last night, a doctor in New York City who recently returned from treating Ebola patients in Guinea has become the first person in New York City to test positive for the virus. Officials told a press conference at Bellevue hospital that they were monitoring 4 people with whom Spencer had contact. His fiancée and two friends had been quarantined, while the fourth person, a taxi driver, was not considered to be at risk

So with Ebola roaring back, many are wondering if the same fears that sent the market turmoiling in late September and early October will also return, most prominently global commodity deflation, slamming the EMs. In this regard, commodity markets remain relatively tentative nonetheless, WTI crude futures trade in the red in a continuation of recent losses, with BofA seeing downside risks to WTI oil prices over the next three months. In terms of metal specific news, China’s copper production rose to a record high in September of 715,000 tonnes, an increase of 5% M/M and analysts at Goldman Sachs say that iron ore prices should remain supported in the short term, adding there is no obvious catalyst that would drive prices outside the recent range.

In other market news, Asian equities traded mostly higher, albeit off their best levels following notable weakness observed across US equity futures after confirmation that a patient who was being tested for Ebola in NYC tested positive for the disease. Nikkei 225 (+1%) shrugged off the negative sentiment seen across US futures with the index supported by yesterday’s movements in USD/JPY, positive Wall Street close and the WSJ report of potential further BoJ easing.

European equities opened in a sea of red as participants remained cautious regarding the overnight confirmation of the first Ebola case in NY which subsequently weighed on US equity futures. This sentiment proceeded to weigh on travel and leisure related names with consumer staples the underperforming sector in Europe, while a negative pre-market report for BASF (after they cut their 2015 EBITDA forecast) has also weighed on chemical names. The now traditional surge in the USDJPY at Europe open, as a result of central bank stabilization, managed to push US equity futures somewhat higher and well off their overnight lows.

The only thing on the US docket today is New Home Sales at 10:00 am.

*Bulletin Headline Summary from Bloomberg and RanSquawk*

· European equities trade in the red amid renewed concerns over Ebola after the first case in NY was confirmed overnight.

· GBP outperformed FX markets in European trade following the UK GDP release confirming the longest uninterrupted run of growth in three years, although GBP/USD has since pared these gains heading into the NA open.

· Looking ahead, today sees the release of US new home sales as well as a host of sovereign debt ratings including Germany, Italy, Spain, Russia and Austria all due for release.

· Treasuries gain, paring week’s decline, as equity-index futures fall after New York City doctor tests positive for Ebola, first case in most populous U.S. city.

· The doctor is being treated in an isolation unit at Bellevue Hospital Center in Manhattan; officials are monitoring those who were with him as he traveled on the subway, went bowling and had close contact with several people

· U.K. GDP rose 0.7% in 3Q vs 0.9% in 2Q, matching median estimate in Bloomberg survey; slowdown comes as BoE policy makers become more concerned about threats from the weakness in the euro area, Britain’s biggest trading partner

· Britain’s decades-long battle over the EU budget flared up again with Prime Minister Cameron resisting a call for the U.K. to pay more to finance the EU’s institutions in Brussels

· The U.K. Independence Party will test its ability to win over voters from across the political spectrum next week when it seeks to seize control of a police authority in the opposition Labour Party’s political heartland

· At noon in Frankfurt on Sunday, ECB plans to release results of its stress tests of currency bloc’s 130 biggest banks

· After two previous tests run by European Banking Authority didn’t reveal problems at lenders that later failed, the ECB has staked its reputation on getting the exercise right

· Denmark won’t back a proposal to split Europe’s biggest banks as the region’s first country to enforce bail-in rules questions the value of more regulation

· China’s new-home prices fell in all but one city monitored by the government last month as the easing of property curbs failed to stem a market downturn amid tight credit.

· Sovereign yields mostly lower. Asian stocks mixed, with Nikkei higher, Shanghai lower; European stock, U.S. equity- index futures fall. Brent crude falls 1.1%; copper gains, gold little changed

*US Event Calendar*

· 10:00am: New Home Sales, Sept., est. 470k (prior 504k)

· New Home Sales m/m, Sept., est. -6.8% (prior 18%

*ASIA*

JGBs traded up 12 ticks at 146.47 underpinned by spill-over buying in USTs on the US Ebola reports. Prices were further supported by the BoJ offering to buy JPY 1.05trl of government debt incl. JPY 400bln in 5-10yr maturities. Asian equities traded mostly higher, albeit off their best levels following notable weakness observed across US equity futures after confirmation that a patient who was being tested for Ebola in NYC tested positive for the disease. Nikkei 225 (+1%) shrugged off the negative sentiment seen across US futures with the index supported by yesterday’s movements in USD/JPY, positive Wall Street close and the WSJ report of potential further BoJ easing.

*FIXED INCOME & EQUITIES*

European equities opened in a sea of red as participants remained cautious regarding the overnight confirmation of the first Ebola case in NY which subsequently weighed on US equity futures. This sentiment proceeded to weigh on travel and leisure related names with consumer staples the underperforming sector in Europe, while a negative pre-market report for BASF (after they cut their 2015 EBITDA forecast) has also weighed on chemical names.

Nonetheless, the periphery has provided some light at the end of the tunnel for European stocks with the FTSE MIB the notable outperformer following Italian press reporting that Banca Monte dei Paschi would not sell stock to fill any potential capital shortfall. However, an Italian Banks Association Official said it will not be simple to interpret results of ECB stress tests and they could lead to market volatility. Elsewhere in Europe, equities still remain in the red, which has subsequently supported fixed income products, albeit amid particularly light volumes (173k in the Bund).

In terms of major US stocks news, focus will be on Microsoft and Amazon after their after-market updates, with Microsoft seen higher after-market and Amazon lower. Attention will also turn towards Pfizer after they authorized a new USD 11bln share buyback program.

*FX*

In FX markets, GBP/USD was the notable outperformer following the UK advanced Q3 GDP release, which came in-line with expectations (Q/Q 0.7% vs. Exp. 0.7%) but provided some relief to those who had been looking for a lower reading, in line with the recent slew of weak UK data. The ONS also said the release marked the longest uninterrupted run of growth in three years, which subsequently saw GBP/USD break above yesterday’s highs of 1.6060 after tripping stops, although has since pared some of these gains. The RUB has continued to weaken in European trade ahead of the S&P’s rating announcement for the country and following RBS’ forecast yesterday that the sovereign would be cut to junk.

*COMMODITIES*

Commodity markets remain relatively tentative with all attention now turning towards how the US will react to the confirmation of the overnight news of the first case of Ebola in New York. Nonetheless, WTI crude futures trade in the red in a continuation of recent losses, with BofA seeing downside risks to WTI oil prices over the next three months. In terms of metal specific news, China’s copper production rose to a record high in September of 715,000 tonnes, an increase of 5% M/M and analysts at Goldman Sachs say that iron ore prices should remain supported in the short term, adding there is no obvious catalyst that would drive prices outside the recent range.

* * *

*DB's Jim Reid concludes the overnight recap*

The gyrations of markets are much easier to fathom these days and after a week of a spectacular recovery in risk we thought it would be interesting to start with the latest flow numbers in HY which came out overnight. Overall it seem HY fund flows at the moment are following the (expected) future growth as US funds saw inflows whilst Western European funds suffered another week of outflows. Per EPFR’s data, the US HY mutual funds saw their strongest week since mid-August with $2bn of inflows. This came after outflows last week of $863m. The picture in Western European funds was far less positive, as they experienced $432m of outflows, the 4th week of negative numbers in row. It will be interesting to see whether yesterday’s PMI’s have any impact on these patterns.

Indeed trading over the last 24 hours has been dominated by the flash PMIs. The day began with the Japanese and Chinese manufacturing PMI’s both coming in ahead of expectation at 52.8 and 50.4 respectively. The bigger market moving numbers though came from the European and US releases later in the day. Whilst the European numbers began disappointingly with a much weaker than expected 47.3 French manufacturing PMI, the stronger than expected 51.8 German manufacturing equivalent managed to turn sentiment around. This was followed by the Eurozone manufacturing PMI which also came in ahead of expectation at 50.7 (49.9 expected). Later in the day the weaker than expected US manufacturing PMI read of 56.2 (vs 57 expected) did not harm sentiment.

At the end of today’s PDF we include our PMI vs equity table again which we’ve now updated for the new European and Asian reads. As we discussed yesterday we generally view this analysis as a guide rather than anything more serious. The main developments given yesterday’s data and market moves are in the European market where Germany has gone from looking relatively ‚fair value? to now being roughly 8% ‚undervalued? thanks to yesterday’s stronger PMI. On the flip side, France has gone from being about 2% ‚undervalued? to now being around 4% overvalued.

Markets reacted very positively to these PMI developments. In Europe the Stoxx 600 rallied +0.7% whilst the Euro Stoxx was up 1.2%. The credit reaction was slightly more muted as iTraxx Main and Xover both tightened by -1bp. US markets were also strong with the S&P500 ending the day up +1.3% whilst in credit CDX IG and HY tightened by -2bps and -10bps respectively. Govvies struggled in the risk-on environment - the Germany and US 10Y rose +3bps and +6bps respectively.

Also helping markets yesterday were relatively upbeat results with Caterpillar a big focus. DB’s Alan Ruskin had an interesting comment yesterday on their Q3 results. He wrote how, "*for those looking at Caterpillar’s Q3 results and drawing positive things about the global economy, the actual detail showed a world distinctly lacking in balance, with N.America doing all the ‘heavy lifting’ while China’s and Latam’s comparisons are notably weak*.? He pointed out a number of comments in Caterpillar’s Q3 Earnings Release including their statement that they, "*expect the Chinese construction machine industry to remain challenged in the near future,"* on the one hand whilst on the other they noted how, "sales decreases in Asia/Pacific and Latin America were about offset by increases in North America." These comments chime in well with the IMF’s last global economic forecasts, which also stressed the role of the US in lifting global growth rates going forward. No pressure then.

Headlines this morning are dominated by the news that overnight a doctor in New York has tested positive for Ebola, the first diagnosed case in the city. S&P futures are trading -0.5% lower as we go to print on the back of this and Asian markets are generally mixed with bourses in Hong Kong, China and Korea moving -0.3%, +0.2% and -0.5% respectively whilst the Nikkei (up +0.8%) is the standout performer on the back of a 0.7% weakening of USDJPY yesterday during European and US trading times . Sentiment hasn’t been helped as China reported disappointing house price data as average prices declined 1.0% relative to August marking a fifth consecutive monthly drop. Meanwhile in Korea, Q3 GDP came in line versus expectations at 0.9% QoQ.

Looking to the day ahead, in Europe we have the November GfK consumer confidence read (expected in at 8), UK advanced Q3 GDP (expected in at +0.7% QoQ) and Italian September wage growth data. Over in the US we have September new home sales (expected in at -6.8% MoM).

Importantly, banks will find out the results of the AQR tests today with the results made public at noon on Sunday. Earlier in the week we had reports from Spanish news source Efe that eleven banks across five nations had supposedly failed the tests including Erste Bank, Banco Popolare and Dexia. However this has been quickly downplayed with a Reuters article quoting an Erste Bank spokesman as saying "Out of the supervisory dialogue we have no indication we won’t pass". The article also quotes positive comments from senior Cypriot and Spanish officials over confidence that their respective domestic banks should fare well through the tests whilst a further article mentions that the German Bank most at risk of failing, HSH Nordbank, is set to meet the requirements. This will dominate the headlines before Monday morning but don't be surprised to see more leaks today ahead of this. Reported by Zero Hedge 3 hours ago.