Following the Friday plunge in the ISM-advance reading Chicago PMI, it was a night of more global manufacturing data, which started off modestly better than expected with Japanese Tankan data, offset by a continuing decline in Chinese PMIs (which in a good old tradition expanded and contracted at the same time depending on whom one asked). Then off to Europe where we got the final print of the June PMI which continued the trend recent from both the flash and recent historical readings of improvement in the periphery, and deterioration in the core. At the individual level, Italy PMI rose to 49.1, on expectations of 47.8, up from 47.3; while Spain hit 50 for the first time in years, up from 48.1, with both highest since July and April 2011 respectively. In the core French PMI rose to a 16-month high of 48.4 from 48.3, however German PMI continued to disappoint slowing from 48.7, where it was expected to print, to 48.6. To the market all of the above spelled one thing: Risk On... at least until some Fed governor opens their mouth, or some US data comes in better than expected, thus making the taper probability higher.

Following the Friday plunge in the ISM-advance reading Chicago PMI, it was a night of more global manufacturing data, which started off modestly better than expected with Japanese Tankan data, offset by a continuing decline in Chinese PMIs (which in a good old tradition expanded and contracted at the same time depending on whom one asked). Then off to Europe where we got the final print of the June PMI which continued the trend recent from both the flash and recent historical readings of improvement in the periphery, and deterioration in the core. At the individual level, Italy PMI rose to 49.1, on expectations of 47.8, up from 47.3; while Spain hit 50 for the first time in years, up from 48.1, with both highest since July and April 2011 respectively. In the core French PMI rose to a 16-month high of 48.4 from 48.3, however German PMI continued to disappoint slowing from 48.7, where it was expected to print, to 48.6. To the market all of the above spelled one thing: Risk On... at least until some Fed governor opens their mouth, or some US data comes in better than expected, thus making the taper probability higher.More PMI by country:

· Ireland 50.3: 4-month high

· Spain 50.0: 26-month high

· Italy 49.1: 23-month high

· Netherlands 48.8: 4-month high

· France 48.4: (flash 48.3) 16-month high

· Austria 48.3: 4-month high

· Greece 45.4: 24-month high

· Germany 48.6 (flash 48.7): 2-month low

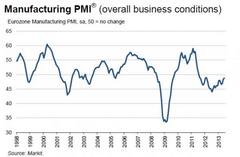

Overall, at the macro level Markit reported that the Final Eurozone Manufacturing PMI at 16-month high of 48.8 in June up from a flash: 48.7, with the PMIs rising in all nations except Germany. How sustainable is this latest bifurcation at a time when the periphery-supporting carry trade is ending will be seen very soon.

The above manufacturing data, together with hope that China's liquidity situation may be normalizing following yet another drop in Chinese SHIBOR reats (it isn't, and once the market realizes that China is effectively undergoing a $1 trillion deleveraging the eye of the hurrican will shift) has set a mood of optimism for the first day of the second half, sending US futures sufficiently high to nearly offset all of Friday's losses.

More on sentiment from Ransquawk:

Stocks in Europe continue to edge back toward their best levels of the session, as market participants react positively to reports that Japonica Partners amended its Greek bond offer and increased total size of offer to EUR 4.0 bn from EUR 2.9 bn, however at a price of 40% of par, compared to 45 cents a month ago.

· Of note, Japonica Partners said it would purchase the Greek bonds issued last year through a tender offer that expires today. Japonica said it planned to purchase almost 10% of the total debt outstanding, which has a face value of EUR 29.6 bn.

· Peripheral bond yield spreads are seen tighter by 8-13bps, while the Euribor curve is trading marginally steeper. However credit spreads continue to show signs of improvement, with the iTraxx Crossover index down 8 bps

· Stocks being driven higher by consumer services and industrial sectors. The risk on sentiment remains supported by better than expected macroeconomic data out of Europe and the UK this morning. While overnight in Asia, the Nikkei 325 also benefited from a positive BoJ Tankan survey, which pointed to an improving outlook to Japan's industries.

On today's docket we have Manufacturing ISM which should make for interesting reading in light of last Friday’s

disappointing Chicago PMI print which came in at 51.6 vs the previous

month’s reading of 58.7 and consensus expectations of 55.0. In keeping with the tradition of Baffle with BS, we expect the ISM to come in well above expectations to offset the major Chicago PMI disappointment.

* * *

Goldman has more on the European June PMI data:

*Bottom line: *The Euro area final manufacturing PMI for June printed at 48.8, 0.1pt higher than the Flash reading (and consensus expectation). The June final manufacturing PMI stands 0.5pt higher relative to the May reading and 2.1pt above the April reading. Among the large Euro area economies, material increases in June were registered in France, Italy and Spain, while a somewhat noticeable (0.8pt) decline was recorded in Germany.

1. The final reading of the June manufacturing PMI for the Euro area was 48.8, one tenth above the flash reading released on June 20. This Final/Flash difference is somewhat consistent with developments since January, where the final manufacturing PMIs have been 0.2pt higher than the Flash print on average.

2. The final Euro area manufacturing PMI was up half a point in June, building on previous gains in May. The index now stands at its highest level since February 2012 and has generally been trending upwards since reaching a trough of around 44 during last summer.

3. The forward-looking orders-to-stocks difference rose further as the increase in the 'new orders' sub-component (0.3pt) was higher than the increase in the 'stock of finished goods' sub-component (0.1pt). New orders rose more materially in May and with the (small) increase in June, Euro area new orders now stand 4pt higher than in April and at the highest level since mid-2011.

4. The figure for Germany was revised down marginally relative to its Flash reading. The German manufacturing PMI came in at 48.6, 0.1pt down relative to its Flash and 0.8pt down on the month. In contrast, the French PMI came in one tenth above the Flash reading, and the index rose 2pt on the month to 48.4 (Chart 1). The German manufacturing PMI decline in June may be related to the flooding, and other German business indicators, such as the flash services PMI and the Ifo, showed robust increases in June.

5. Unlike Germany and France, the Italian and Spanish manufacturing PMIs do not provide a flash reading. Both the Italian and Spanish PMI showed a monthly gain; now for the third consecutive month. The June Italian manufacturing PMI rose from 47.3 to 49.1, notably higher than expected (Cons: 47.8). The Spanish PMI also surprised on the upside in June, improving from 48.1 to 50.0 (Cons: 48.5).

6. Manufacturing PMIs outside the four major Euro area economies rose modestly on the month. The largest increase was registered in Ireland which rose half a point (to 50.3). The manufacturing PMI for Greece and the Netherlands also ticked up (Chart 2).

7. In our macroeconomic forecast, we expect the Euro area recession to continue in the first half of 2013, with a stabilisation of economic activity in the second half of the year and a very modest recovery in area-wide GDP towards year-end. Both our PMI-based indicator and the Euro area CAI improved for a third consecutive month after declines in February/March.

DB's Jim Reid has the full weekend event recap, and what to look forward to:

The week ends with a payroll report that will have the market on tapering tenderhooks although Independence Day the day before might leave the markets more sparsely populated than usual for such a big release. As we stand, consensus is forecasting a 165k and 175k gain in the headline and private payrolls respectively (vs 175k and 178k previous). The unemployment rate is expected to tick down to 7.5% from 7.6%. A number around this level won't really settle the tapering argument but one notably below or above will certainly lead the arguments fairly aggressively one way or the other. So with time running out until the September FOMC, such prints are going to be huge for markets. Other important data releases include today's ISM manufacturing (consensus 50.5) and all the usual equivalent PMI numbers from around the globe. China has kicked off proceedings this morning with an official manufacturing PMI reading for June of 50.1. Though in line with consensus estimates, the result is the lowest in four months. Meanwhile the final HSBC manufacturing PMI came in at 48.2, slightly below a preliminary reading of 48.3 and 1pt below the final May reading of 49.2.

The reaction from Asian markets this morning to the Chinese data has been relatively muted. Most Asian equities are trading about half a percent lower but this was partly driven by the late sell-off in US equities on Friday which saw the S&P500 (-0.43% on the day) lose 0.6% in the final half hour of trading. The Hang Seng is closed for a public holiday today while the Shanghai Composite (-0.8%) and ASX200 (-1.4%) are both softer. The Nikkei is +0.4% helped by a strong Tankan quarterly survey which continues the recent run of better Japanese data. The large manufacturers’ index improved to 4 versus estimates of 3 and Q1’s reading of -8. The large manufacturers’ outlook component increased to 10 (vs 7 expected and -1 previously). The dollar-yen’s creep back up to 100 (99.4 as we type) is also helping sentiment in Japanese equities.

Aside from the PMIs there was also a fair bit other China-related news over the weekend. Firstly, there were some interesting comments from President Xi over the weekend on growth. The state news agency, Xinhua, quoted President Xi as saying that the performance of government officials shouldn’t be judged solely on their record in boosting GDP growth and more importance should be placed on improving people’s livelihood, social development and environmental quality.

*Some commentators have taken this to mean that top officials are legitimising the case for slower growth. *As far as bank liquidity is concerned, the Chairman of China’s banking regulator said in a speech over the weekend that banks had about RMB1.5trillion in excess reserves as of June 28th that could be used for payment and settlement needs, or 2x normal requirements.

We should also note the ECB meeting this week which could be interesting even if the general consensus is for no changes in refi/deposit rates. At moment only one economist surveyed by Bloomberg is expecting the ECB to cut the refi rate, and no economists are expecting a cut in the deposit rate to negative territory at this meeting. Nevertheless, Draghi's press conference usually offers up something for the market to pounce upon. Also worth watching out for is chatter about redemptions now we've passed H1 end. This has been scaring a lot of people I've talked to over the last week or so. Will there be a deluge post month/half year end in EM (equities and FI), rates and credit? That's the billion dollar question.

Over the next 24 hours, final Euroarea PMIs (including the first readings for Spain and Italy) and the US ISM manufacturing will be attracting most of the attention. The ISM should make for interesting reading in light of last Friday’s disappointing Chicago PMI print which came in at 51.6 vs the previous month’s reading of 58.7 and consensus expectations of 55.0. Over the course of the rest of the week, there will be plenty of economic data releases as we build up to the Thursday’s ECB meeting and Friday’s all-important payrolls.

Starting with Tuesday, we have US factory orders and the RBA’s board meeting. On Wednesday, the focus will be on the services PMIs for China and the Euroarea. The US non-manufacturing ISM and ADP employment prints will provide the final indications on the trend in employment ahead of Friday. US equity markets shut early on Wednesday ahead of Independence Day on Thursday. On Thursday, we have the ECB meeting/Draghi press conference together with the BoE’s first MPC meeting with Carney at the helm. Friday will be all about payrolls, but we should also highlight that German factory orders and Spanish IP will be released on the day.

* * *

SocGen's macro highlights see, not surprisingly, the ECB's wednesday meeting the the Friday NFP as the key events of the week.

Anything but a quiet start to the week and the second half of the year is pencilled in for today in the wake of Friday's whipsaw price action across different asset classes. A good deal of anxiety has returned to the market after a deceptive bounce in risk assets in the middle of last week, and which has accordingly seen positions adjusted in the light of dovish central bank speak (Fed, ECB, BoE). Gold in particular (and the ZAR as a result in EM FX) continues to bear the brunt of corrective flows and technically the slide may not be over until stability returns around the $1,155 level even as prices are staging a decent $20 bounce overnight.

This week is indeed all about the ECB and US non-farm payrolls, two events separated by the 4th of July holiday in the US, and so there will be a 24-hour stint where liquidity could be poor and thus have a significant bearing on the price action. If the ECB was surprisingly neutral last month, risk/reward suggests a more candidly dovish message this time despite a round of better data. As we pointed out on Friday, the constellation has changed after the spike in periphery yields and council members gave the game away last week by stressing the importance of accommodation in the light of rising US yields to keep control of funding and borrowing rates in the periphery. *Fresh policy initiatives are unlikely to be on the table, but press reports that a ‘360-degree review' of the ECB's tools is underway means concrete measures may soon be presented if the periphery sell-off worsens*. Ironically, US payrolls data on Friday may be the judge of that. *Solid data will nudge the Fed closer to tapering and could bring about another leg of higher yields*. The SG forecast of the manufacturing is 51.5, above the consensus of 50.5. Also due today are final EU PMIs, CPI, unemployment and the UK manufacturing PMI.

Ahead of the RBA decision tomorrow, AUD/USD sank to a 33-month low on Friday and, briefly trading below 0.9144, will have pushed bulls deeper into hibernation. Technicians are targeting a 6% move to 0.8550 from here, and could get some help from the central bank if another dovish message is rolled out in the statement. Given the weak data from China lately, there could be another push lower in short-term Australian yields. Reported by Zero Hedge 3 days ago.